Darius recently sat down with Bleakley Financial Group CIO Peter Boockvar to discuss the impact of the Trump administration’s proposed tariffs, insights from the 42 Macro Positioning Model, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. What Are The Second And Third Order Effects Of Tariffs And How Might They Cause Problems For Asset Markets?

According to data from the Committee for a Responsible Federal Budget, the Trump administration’s proposed tariffs are expected to generate nearly $3 trillion in revenue to help offset the ~$4+ trillion cost of permanently extending the Tax Cuts and Jobs Act (TCJA).

We believe the market is underestimating both the likelihood and scale of these tariffs given that the Congressional budget reconciliation process – specifically the Byrd Rule – will require pay fors to offset the lost revenue from tax cuts. An equally important but often overlooked factor is the potential for retaliation, particularly from China.

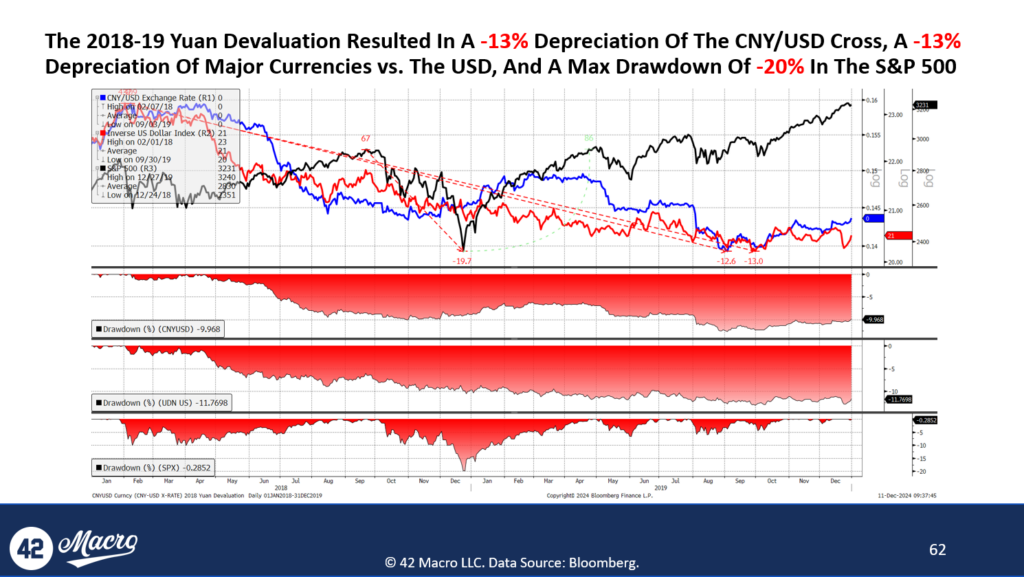

Historical examples, such as the Trump-era trade war, illustrate how heightened tariffs can lead to significant devaluations of the Chinese yuan. If this pattern repeats, it is likely to trigger competitive devaluations among other major currencies, resulting in an excessively strong U.S. dollar. In our view, such dollar strength is likely to suppress global capital formation and weigh heavily on U.S. corporate earnings, ultimately creating a significant headwind for asset markets.

2. What Insights Does The 42 Macro Positioning Model Provide About The Current State of Asset Markets?

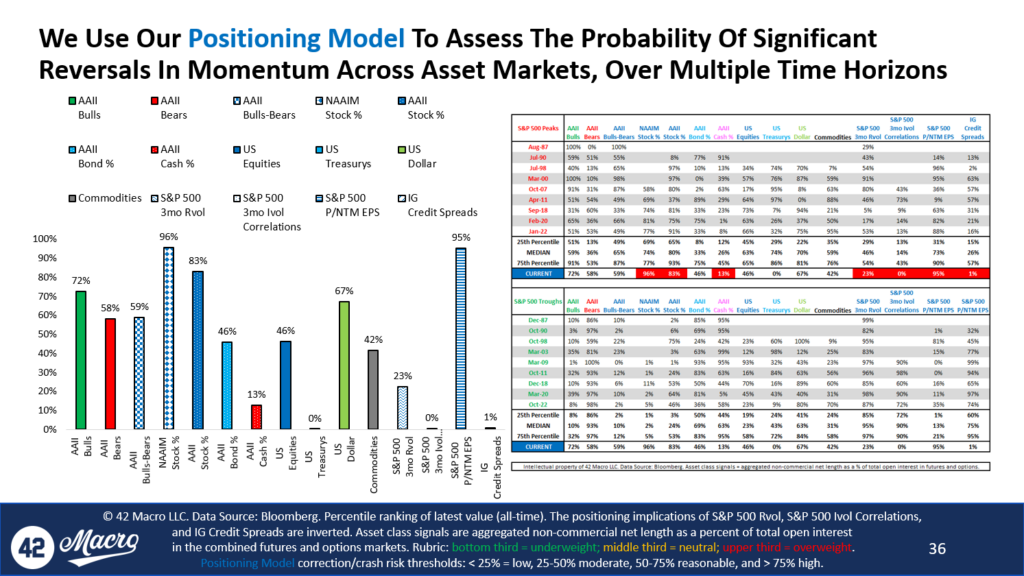

Our 42 Macro Positioning Model analyzes a 15 long-term time series, comparing their current levels to the median values observed at major bull market peaks and troughs. Currently, the model indicates several red flags for positioning and sentiment:

- AAII stock allocation exceeds the median value observed at major bull market peaks in the seven market cycles since Jan-98.

- AAII cash allocation is also below the median value observed at major bull market beaks.

- S&P 500 realized volatility—an inverse proxy for systematic fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 implied volatility correlations—an inverse proxy for market-neutral hedge fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 price/NTM EPS ratio sits in the 95th percentile of all historical data, dating back to the late 1980s, and is well above the median value observed at major bull market peaks.

- Investment-grade credit spreads are in the first percentile of all historical data, also dating back to the late 1980s, and are well below the median value observed at major bull market peaks.

From a positioning perspective, although these metrics do not necessarily serve as immediate catalysts for reversing the bullish momentum of risk assets, they represent significant potential energy once bearish catalysts emerge. When momentum does reverse, we believe positioning is asymmetric enough to unwind in an aggressive-enough manner to cause a stock market crash.

Since our bullish pivot in November 2023, the QQQs have surged 48% and Bitcoin is up +203%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.