1) The US Economy Remains on a Path to a Recession

At the beginning of the year, most investors expected a first-half recession followed by a recovery in the second half.

Since last summer, our view has consistently been that the U.S. economy had more endurance than what was perceived by most investors.

This belief led us to forecast a later start to the recession, in late-2023, contrary to the general market consensus.

Our view was, and still is, that a recession would likely kick off in Q4 of this year or Q1 of next year.

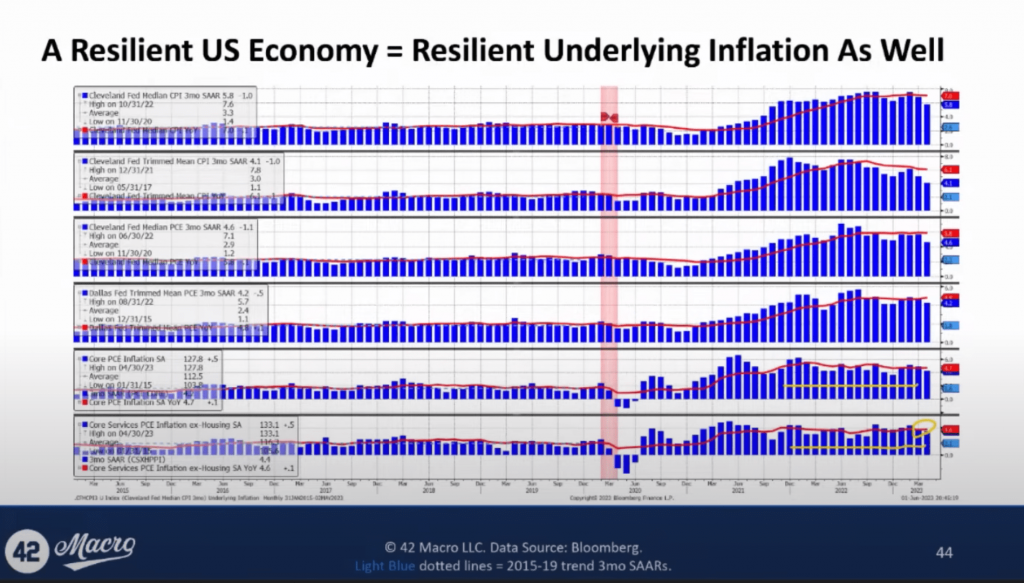

2) Inflation Will Not Reach 2% Without a Recession

U.S. inflation, a lagging business cycle indicator, usually breaks down during and through a recession.

Our data suggests that it’s improbable we will see evidence of sustainable 2% inflation before a recession hits: our models currently forecast inflation stabilizing at around 3-5%, not the Fed’s 2% target.

This could lead to two potential outcomes: either the Fed acknowledges more action is needed, or the bond market panics over the lack of progress.

Either way, we believe it will result in the Fed applying more pressure, pushing the economy into recession.

3) Europe’s Economic Contraction Will Likely Worsen

The European economy has recently confirmed its recession, primarily due to the effects of monetary tightening.

Despite the assumptions that fiscal stimulus would resolve the situation, Europe’s economy is in decline, with retail sales tracking down 2% to 4% across Europe.

Given the current data, we predict the recession in Europe is likely to worsen over the medium term.

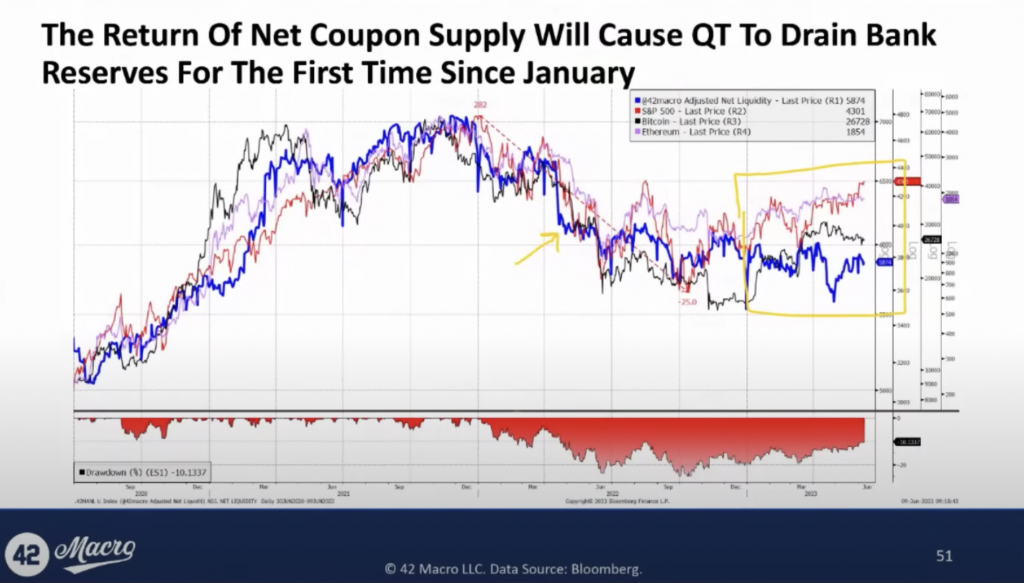

4) Upcoming Quantitative Tightening Will Negatively Impact Asset Markets

The return of net coupon supply will instigate QT, causing it to deplete bank reserves for the first time since January.

Our Adjusted Net Liquidity model, which subtracts the Treasury General Account (TGA) balance and Reverse Repo Facility (RRP) balance, as well as emergency lending from the Fed’s balance sheet, shows a breakdown in the correlation between US public sector liquidity and asset markets at the beginning of the year when QT ceased draining bank reserves.

Up until now, QT has truly been going on in the background.

We believe this correlation will resume in the coming months and negatively affect risk assets.

5) The Stock Market Is Likely To Peak During Q4 (or Early In Q1 At The Latest)

Our study of past recessions shows that the stock market, on a median basis, typically peaks a month before the trough in the unemployment rate.

Historically, the stock market usually rises sharply in the year leading up to the end of a business cycle, with a median return of around +16%.

Equity markets are generally strong preceding a recession.

We maintain the view that the stock market will likely peak in Q4 (or early in Q1 at the latest) and many of today’s too-early bears will fail to profit from the pending Phase 2 Credit Cycle downturn.

At that point, we will be positioning for the next anticipated down leg in the market.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!