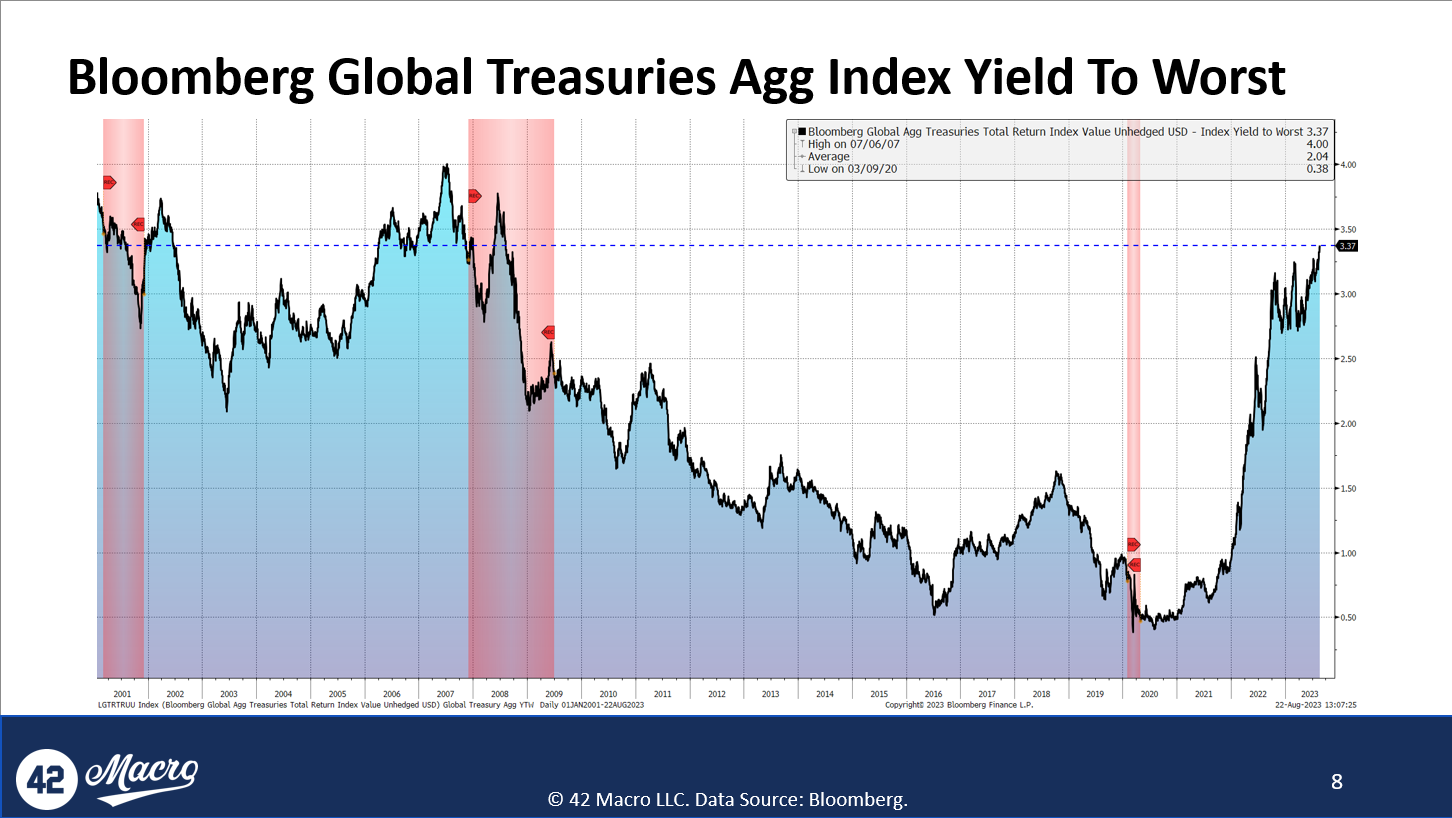

Global bond yields hit their highest level since 2008 as investors were forced by the data we have been highlighting to reprice economic resiliency in places like the US and Japan, as well as sticky inflation in places like the Eurozone and UK.

Last week’s Industrial Production (+210bps to a 2mo high 3mo SAAR of -0.9% in July), Capacity Utilization (+70bps to a 2mo high of 79.3% in July), Building Permits (+590bps to a 3mo high 3mo SAAR of 7.1% in July), Housing Starts (+2,560bps to a 2mo high 3mo SAAR of 30.9% in July), and NY Fed Services Activity Survey (+0.6pts to 0.6 in August; highest since Sep-22) were each marginally confirming of our “resilient US economy” theme.

Market participants are increasingly accepting the “higher for longer” guidance we have seen from a handful major central banks — most notably the Federal Reserve.

Floor policy rate expectations (min value on OIS curve out 2yrs) for the ECB, Fed, and BOE have climbed +3bps, +39bps, and +37bps MoM, respectively.

That’s dragged 10yr Nominal German Bund, US Treasury, and UK Gilt Yields up +18bps, +48bps, +37bps, respectively, over that same duration.

The 10yr Nominal JGB Yield — which is effectively managed by the BOJ — is even up +22bps MoM.