1. China and Japan are Important to the Global Liquidity Cycle:

China and Japan are key contributors to the global liquidity cycle.

Regarding their contributions to the global central bank balance sheet, global narrow money supply, and global FX reserves minus gold – the three metrics that we feature in the @42Macro Global Liquidity Proxy – China makes up ~20%, while Japan makes up ~15%. Understanding their liquidity cycles is vital in forecasting inflections in global liquidity.

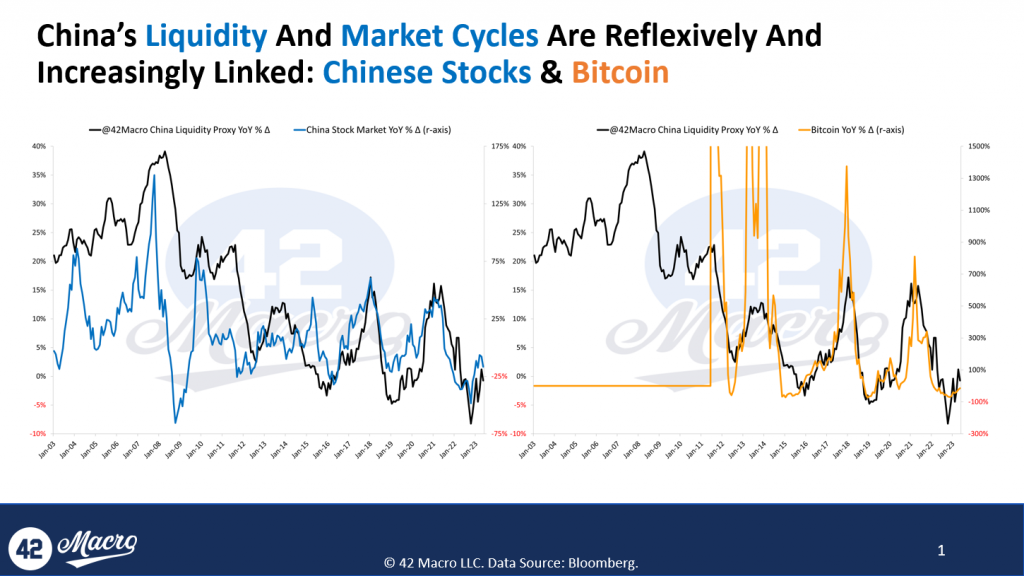

2. The Chinese Liquidity Cycle Has a Big Impact on Asset Markets:

There’s a direct link between China’s liquidity and the global markets, including Bitcoin. Any significant shift in China’s liquidity, positive or negative, can considerably affect asset markets.

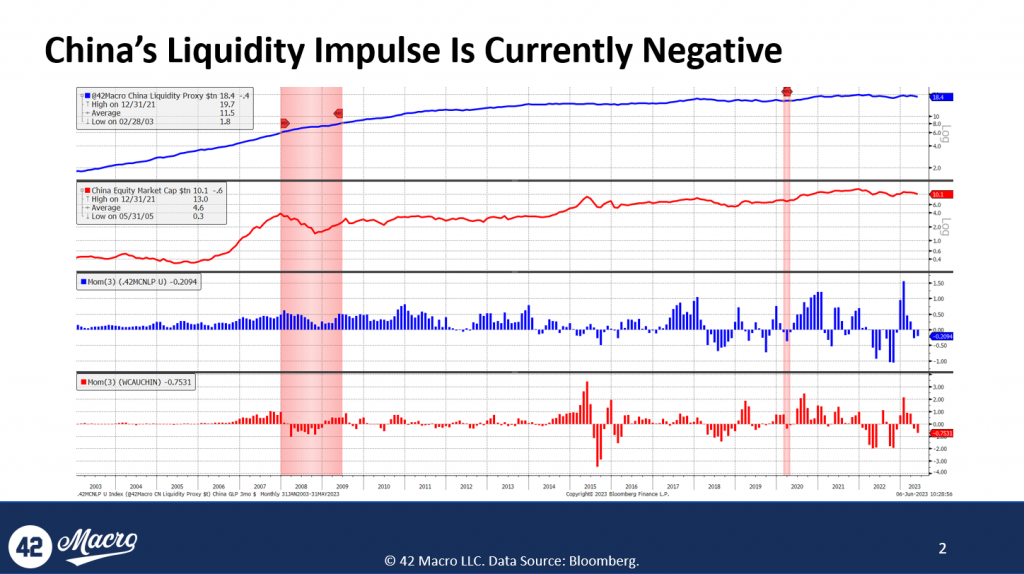

Our research shows that the Chinese economy shifted from adding approximately $1.5 trillion of liquidity in Q1 of this year to removing liquidity in the past few months. The pullback in Chinese liquidity coincides with #Bitcoin failing to continue its rally. We believe we will see another injection of liquidity into the Chinese economy; we just don’t believe it will happen in the short term.

3. Waning Public Sector Liquidity Provision in China:

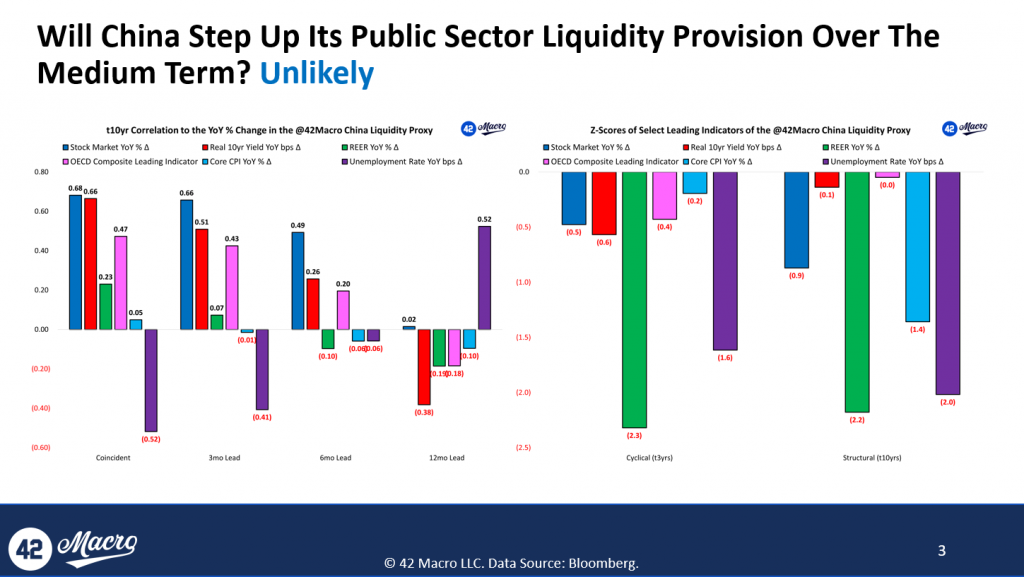

The Chinese stock market is viewed as a reliable leading indicator of the country’s liquidity cycle because locals often have intelligence regarding future actions of the People’s Bank of China (PBOC).

We believe the recent decline in the Chinese stock market likely signals a decrease in China’s contributions to global liquidity over the medium term (because the market doesn’t anticipate a wave of liquidity from the PBOC).

4. Japan’s Liquidity Cycle Influences Bitcoin Too:

Like China, Japan’s liquidity cycle strongly correlates with Bitcoin and other risk assets.

Our research shows that in October of last year, the Japanese economy was removing $1.5 trillion from global liquidity on a three-month impulse basis.

In Q1 of this year, they shifted to add $2 trillion.

Because inflation is still very high in Japan, we do not foresee a liquidity injection from the BOJ in the near term.

5. It’s Not Just Enough to Monitor Global Liquidity; You Must Forecast It As Well:

The timeline for changes in liquidity inputs to manifest in outputs (values or liquidity changes) varies by the economy.

When an economy is at the bottom of its growth cycle (e.g., unemployment rising on a YoY basis, etc.), lead times are usually shorter because central banks will react with a sense of urgency to support their economies.

Conversely, factors like stock market performance and real interest rates in China may not trigger a similar sense of urgency by the PBOC and/or Chinese commercial banks.

Overall, the objective is to understand these dynamics to forecast the global liquidity impulse, which is currently negative. We believe this negative impulse is the reason Bitcoin hasn’t fully recovered its YTD high.

That’s a wrap!

If you found this thread helpful:

- Go to https://42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!